The cost of trading depends on different factors like commissions, spread, and margins. I had the same brutally ruthless scam performed on my finances. I’ve gotten mine back but this is my last time with you guys, trust me. Above all, our experts assess whether a broker is trustworthy, taking into account their regulatory credentials, account safeguards, and reputation in the industry.

Forex trading, also called currency or FX trading, involves the currency exchange market where individuals, companies, and financial institutions exchange currencies for one another at floating rates. Trade360 also offers traders trade 360 review the ability to trade on MetaTrader 5 if they so wish. CrowdTrader sends timely alerts that allow a trader to keep ahead of possible market trend developments and it also detects trend reversals timely when crowd sentiment shifts.

By doing your due diligence and understanding Trade360 platform, you can make informed investment choices that align with your financial goals. So take the time to research Trade360 thoroughly and make the most of your online investing experience. Our team has endeavored to break down the complex world of trading with Trade360 into easily digestible information in this Trade360 review. We want to ensure you have all the knowledge necessary to use the Trade360 trading tools confidently, from depositing and withdrawing funds to executing trades. When it comes to online trading with brokers like Trade360,

carefully review Trade360 as your broker can make or break your success. Choosing the right broker is essential to ensure your Trade360 investments grow and flourish.

Instantly apply the perfect volatility-adjusted trailing stop to any stock in the market to determine the exact time to sell for maximum profit potential. Trade360 warns all potential traders that Forex and CFDs trading always carries a high level of risk and may not be suitable for all investors. Trade360 provides clients with e-books on crowd trading and a FAQ section with details on trading basics. Potential traders need to be assured that the broker company they chose can offer the necessary support and help whenever they may need it.

Trade360 Guide – Read our In Depth 2024 Trade360 Review

We have over 20 years of experience when it comes to trading online so we know what to look for. There is a good range of multiple CFD asset classes, including stocks, ETFs, commodities, indices and Forex. You can trade on CFDs for oil & gold, Nikkei & Nasdaq, and CFDs for stocks from Apple to Yum! Whatever your interests, there is something for everyone to trade. If you want an even greater selection, have a look at RoboForex as they have thousands of CFD instruments. There is a limited amount of educational resources on the Trade360 website, including some handy trading guides.

- One article is dedicated to trading psychology, which I appreciate, as it remains one of the most defining aspects of successful trading.

- It seems to have alot of options for withdrawls and it provides some great options with stocks .

- If you want everything TradeSmith has to offer, Trade360 is the best way to go.

- Trade360 offers various funding payment methods listed in your Trade360 dashboard if available in your region.

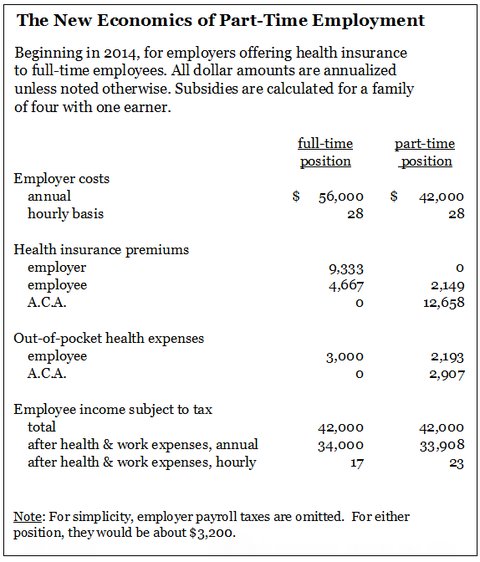

Unfortunately, due to the stringent rules of CySEC, Trade360 is not allowed to offer potential clients any bonuses or inducements to get them to sign up for an account. As such, the offers on the table from Trade360 are non-existent (albeit through no fault of their own). This is an excellent spread of platforms, although Trade360 loses marks for not allowing the Mini account holders to have access to MT5. And they aren’t offered MT4 by way of consolation either, although respect goes to the firm for the development of their proprietary CrowdTrading platform. Remember, this broker also offers the unique CrowdTrading platform, so you can take hints from the trading community and, hopefully, take advantage of market movements in your favour.

Desktop Platform

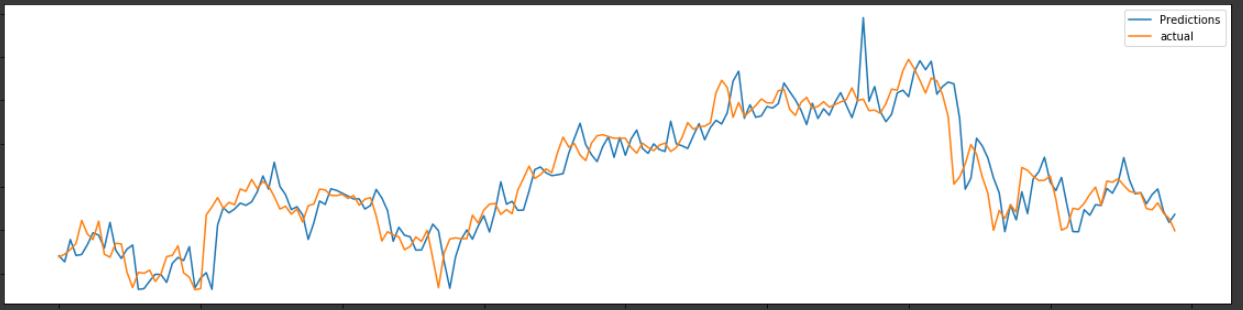

While the price is certainly substantial, it’s well worth the cost of admission. TradeSmith also has a 90-day full-credit refund policy, so you can apply your purchase to different TradeSmith tools if it’s not a fit. You want to get the most out of your nest egg, and you need to ensure your positions are allocated properly to do it. Trade360’s risk rebalancer tool shows you the best potential allocations for each of your holdings, so you’ll never sell yourself short again. Presenter Keith Kaplan said he used this tool to build his recovery portfolio following the 2020 pandemic sell-off in US markets.

Please be careful before using Trade360 !

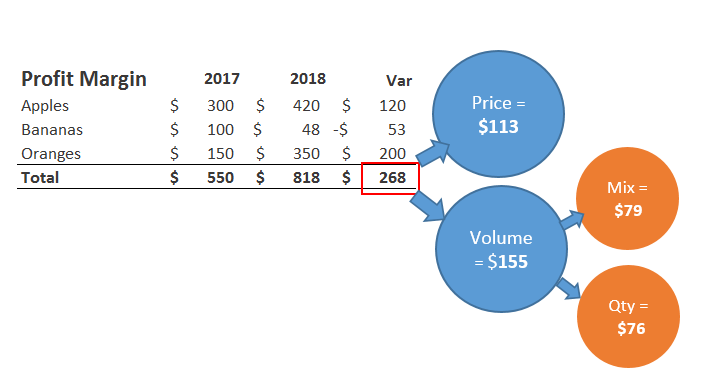

It has the recognition of global business with about five business platform. By using this type of trade service customer can run their business globally and easily. There are different kind of trade offer where customer choose the type of business, he wants to done to get the exclusive opportunity according to the size of business. It has complete diagram and chart how it’s different from another broker. It deals your business safely and rapidly ensuring the profit of your business.

Trade360 Reviews

Fancy finding out whether or not the broker is right for your personal trading needs? We cover the ins and outs of how the platform works, who it is suitable for, what fees you need to be made aware of, and more. I admit it took me a while to get used to their interface when I started working with them, but ever since it’s been OK.

Is my money safe with Trade360?

If that doesn’t help, the usual triumvirate of ways to contact their customer support team is available. There’s a phone line, a messaging service (either via their website or standard email), and live chat, the latter of which is manned 24 hours a day, five days a week. Hi i recently viewed the site and was mostly impressed with what I saw.

How to get Started With Trade360 in 5 Minutes

All of the major e-wallet methods are accepted for deposits and withdrawals, including Skrill and Neteller. When you wish to make a withdrawal from your Trade360 account, you will first need to complete the ‘know your customer’ verification requirements. You can only withdraw using the payment method used for deposits. We would, however, like more – much more – in the way of educational content.

When a trading account goes unused for a certain period, brokerage clients may be charged an account inactivity fee. To avoid such fees, clients may need to fulfill specific trading activity requirements outlined by Trade360 terms and conditions. It’s important to note that inactivity fees are not unique to online trading accounts, as many financial service companies may also charge them. As with currency exchange markets, commodity markets offer different investment opportunities for traders.